Stock split formula

If the company splits its stock 2-for-1 there are now 200 shares of stock and each shareholder holds twice as many shares. After the split the.

Calculate Landed Cost Excel Template For Import Export Inc Freight Customs Duty And Taxes Excel Templates Excel Verb Worksheets

This provides it an industry capitalization of 400 000 000.

. The stock split is done by decreasing the face value of the share. Shares after the splitshares AB Stock price after the splitstock price BA Lets say for instance a company were to execute a 1 to 5 reverse stock. To begin divide the price you paid for the relevant shares.

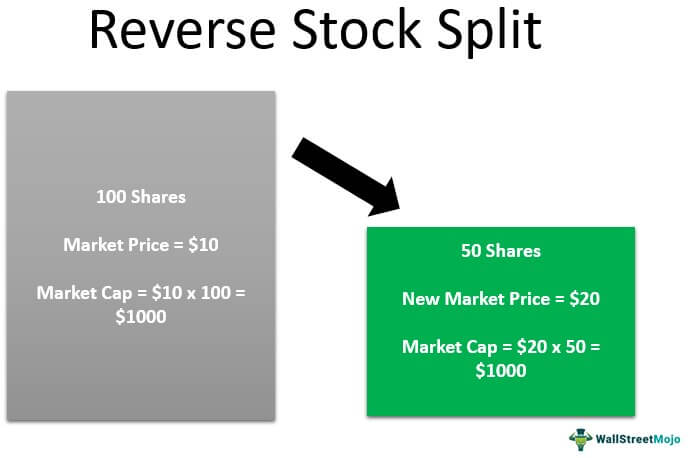

After a reverse stock split the share price rises from the reduction in share count yet the market value of equity and ownership value should remain the same. Ad Learn What You Want When You Want. That is the base price of the.

Calculating New Shares After Split To calculate the number of new shares you will have after a stock split multiply the number of shares you currently own by the number of. Find a Financial Advisor. The face value of the share is the value printed on the share like that of a rupee note.

Our Financial Advisors Offer a Wealth of Knowledge. Right after a stock split youll own more shares but the entire value of your holding shouldnt modify by an important amount. A stock split is when a company divides its existing number of shares into multiple shares.

Searching for Financial Security. Open an Account Now. Simply divide the number of shares you own by the split ratio and multiply the pre-split share price by the same amount.

Searching for Financial Security. But first lets provide the simple formula. Ad Edward Jones Offers Insight on Reliable Investments.

Formula for Calculating Stock Splits. For example a 3-for-1 split would mean a shareholder who owns 1 share in a company. If those coins were stock the split ratio would be 21 or two-for-one.

Open an Account Now. How to Calculate a 3-for-1 Stock Split Sapling. The price of each share is adjusted to 25 5000 200.

Ad Edward Jones Offers Insight on Reliable Investments. Our Financial Advisors Offer a Wealth of Knowledge. Find a Financial Advisor.

To calculate that event correctly you must calculate the per-share basis following the stock split. Calculating the effects of a reverse stock split is easy. An easy way to remember how a split works is to think of it like exchanging one dime for two nickels.

Ad Learn What You Want When You Want. A reverse stock split is when a company decreases the number of shares outstanding in the market by canceling the current shares and issuing fewer new shares based. Formula and Google Example Calculator Excel Template A Stock Split occurs when a publicly-traded companys board of directors decides to separate each outstanding share.

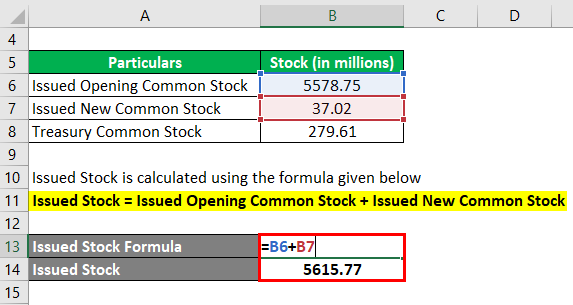

Shares Outstanding Formula Calculator Examples With Excel Template

Shares Outstanding Formula Calculator Examples With Excel Template

The New Pie Slicer Application Slicing Pie Start Up Equity Founder S Shares Dividing Up Stock Equity Splits Business Pie Starting A Business

Stock Splits Financial Edge

Stock Split Formula And Google Example Calculator Excel Template

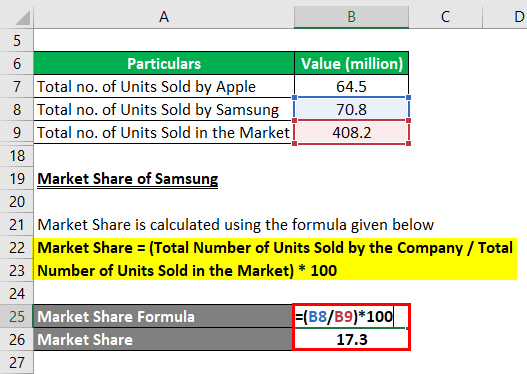

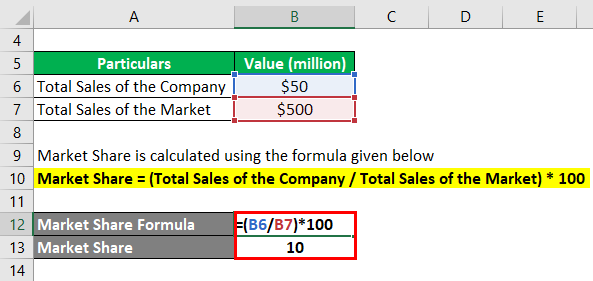

Market Share Formula Calculator Examples With Excel Template

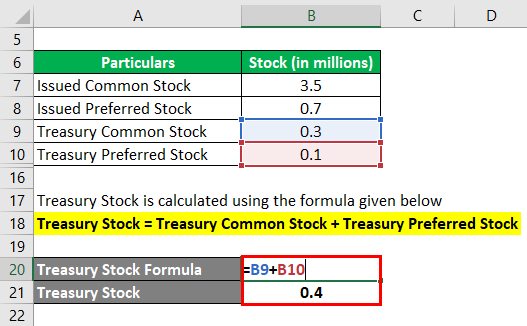

Treasury Stock Method Tsm Formula And Calculator Excel Template

Market Share Formula Calculator Examples With Excel Template

Krazy Glue High Strength Polyvinyl Acetate Homopolymer Advanced Formula Gel 14 Oz Polyvinyl Acetate Gel Formula

An Infographic For Perfect Equity Splits Slicing Pie Start Up Equity Founder S Shares Dividing Up Stock Equity Splits Start Up Equity How To Raise Money

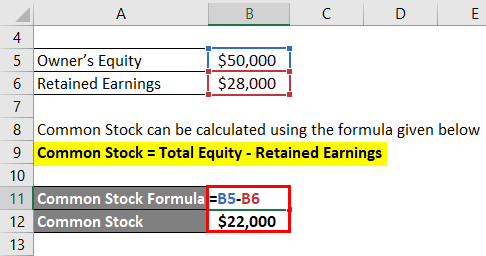

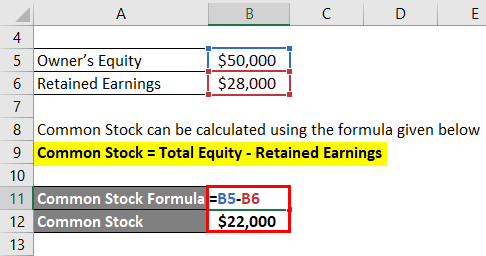

Common Stock Formula Calculator Examples With Excel Template

Stock Split Formula And Google Example Calculator Excel Template

Pin On Ruba

Bonus Shares And Stock Split The Concept Formula And Examples Getmoneyrich

Market Share Formula Step By Step Calculation With Examples

Pin On Ruba

Reverse Stock Split Meaning Example How It Works